Credit Score is a free service for members and is powered by SavvyMoney. It provides the following benefits, and more:

- Daily access to your credit score

- Real time credit monitoring alerts

- Credit score simulator

- Personalized credit report

- Special credit offers

This new feature displays within mobile and online banking dashboards. When you log in for the first time, a licensing agreement pop up will prompt you to accept the Terms and Conditions, and then you will see the Credit Score widget on your dashboard. Using this service does not affect your credit report.

Accessing Credit Score

Mobile App

Three options to access from your home screen in the mobile app:

- Select the banner ad about Credit Score. Choose “Go to SavvyMoney.”

- Select “Explore your Credit Score.” Choose “Go to SavvyMoney.”

- Select Accounts. Scroll down to the bottom and you’ll see “Credit Score & Report.” Select “Show Full Report.”

Online Banking

Two options to access from your main screen in online banking:

- Look at the widget on the righthand side under your account summary called “Credit Score & Report.” Select “Show Full Report.”

- Select on the banner ad about Credit Score. Choose “Go to SavvyMoney.”

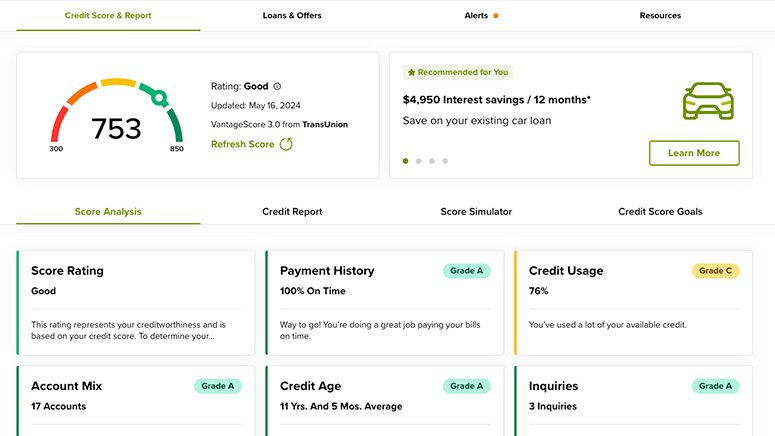

Sample Credit Score dashboard

Frequently Asked Questions

How often does my credit score get updated?

Your credit score is updated every seven days within the Credit Score feature in mobile and online banking. You may also refresh your credit score and full report every 24 hours by clicking “Refresh Score” and navigating to the detailed Credit Score dashboard within mobile and online banking.

What if the information provided by Credit Score appears to be inaccurate?

Each credit bureau has its process for correcting inaccurate information, or you can file a dispute by clicking on the "Dispute" link within the Credit Score credit report.

Will enrolling or accessing Credit Score 'ping' my credit and potentially lower my credit score?

No. Checking your credit score on Credit Score is a "soft inquiry" which does not affect your credit score.

Will this score be used when you apply for loans with Everence Federal Credit Union?

No, we use our lending criteria when making final loan decisions and have no access to Credit Score's information. However, SavvyMoney Analytics can see what offers users view and engage with.